Palm Beach County Market Update: Inventory Rises as Sales Slow

September 23, 2025

Fresh off the press—August 2025 housing reports are in, highlighting the latest trends in Palm Beach County’s real estate market. The data, measured year-over-year, reveals shifting conditions as inventory expands and the market continues to balance.

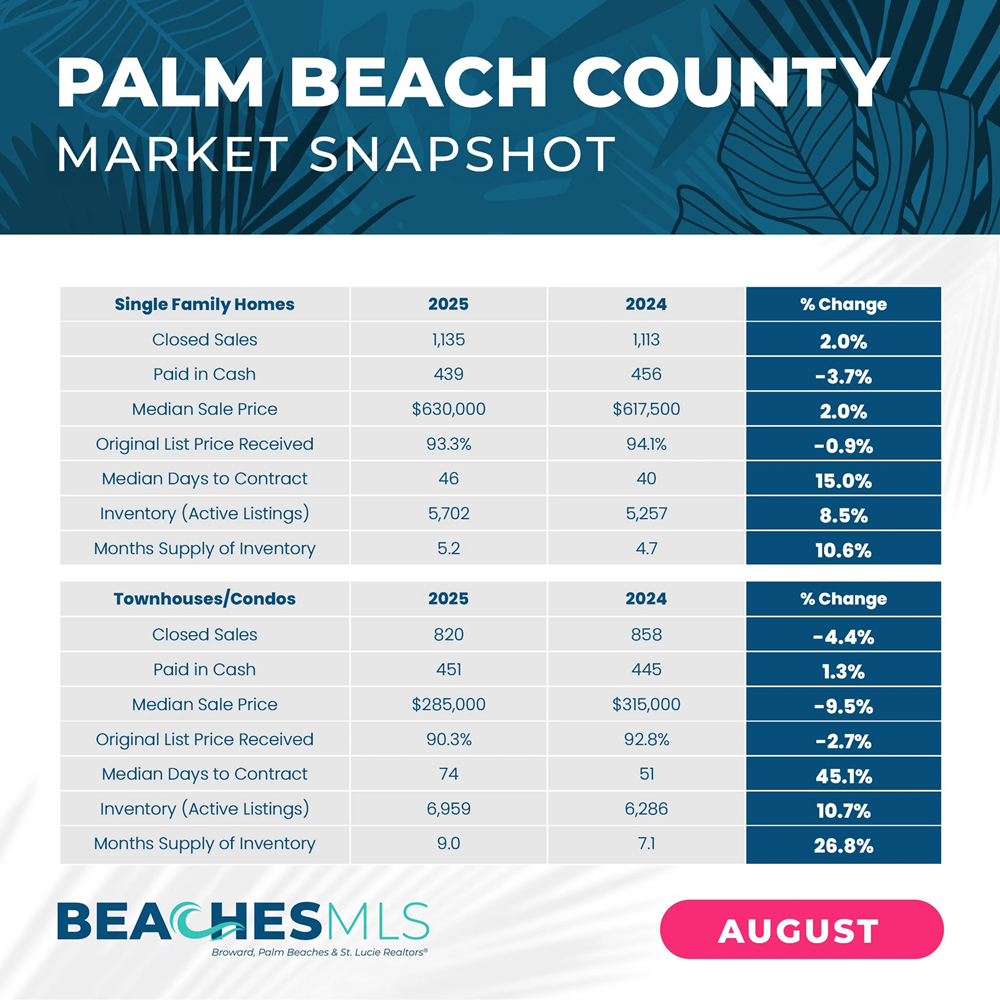

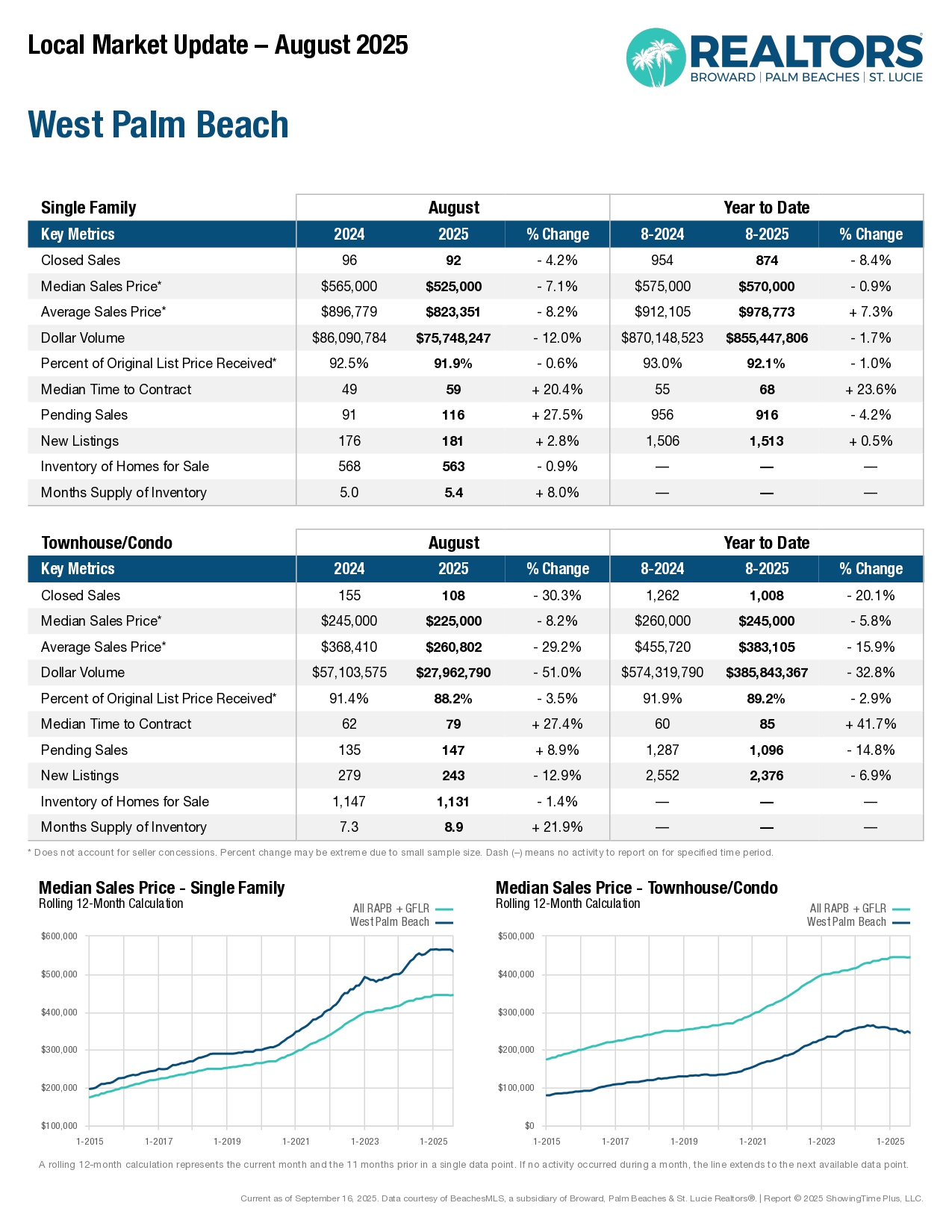

Below are the latest statistics on single-family homes.

Palm Beach County Market Update – August 2025

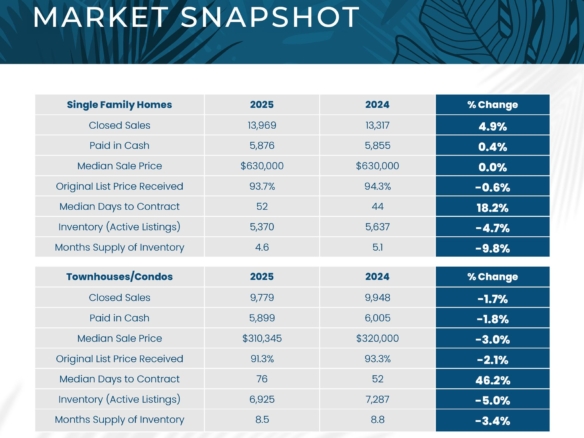

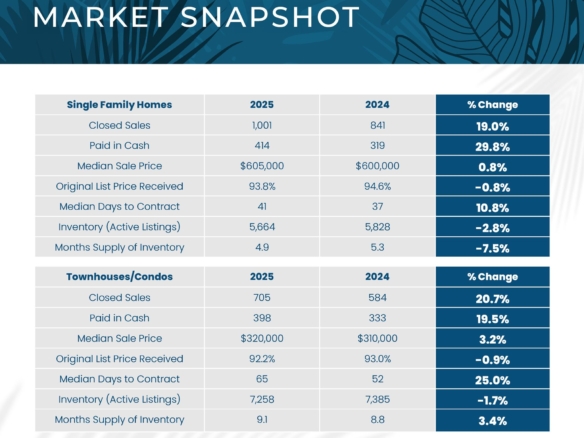

Palm Beach County’s housing market continued its steady transition in August, as sales activity softened while inventory expanded. Closed sales declined 5.3% year-over-year, with 1,330 single-family transactions compared to 1,405 in August 2024. At the same time, active listings climbed 11.6% to 6,156 homes, pushing the months’ supply of inventory up to 5.8. These shifts reflect a market gradually moving toward balance and offering more favorable conditions for buyers.

Pricing, however, remained consistent. The median sale price held firm at $640,000, unchanged from a year ago, underscoring overall stability despite the slowdown in transactions. Homes are taking longer to sell, with the median time to sale rising 8.7% to 88 days, giving buyers added time and leverage in their decision-making process. Cash sales also declined 9.5%, signaling a stronger presence of traditional, mortgage-financed buyers.

“We’re seeing more breathing room in Palm Beach County,” said Jonathan Lickstein, President of the Broward, Palm Beaches & St. Lucie Realtors®. “With more homes on the market and longer timelines, buyers can take their time. It’s also a great opportunity for first-time buyers to explore assumable loans, which can provide significant savings on interest. This powerful financing tool is often overlooked, but a local Realtor® can help you identify and secure it.”

Spotlight on Assumable Loans

Assumable loans allow buyers to take over a seller’s existing mortgage—often at a significantly lower interest rate than today’s market offers. Many homeowners locked in historically low rates before increases in recent years, and transferring those loans can mean substantial long-term savings. While not every property qualifies, a Realtor® can help pinpoint homes with assumable financing and guide you through the process.

Why Work With a Local Realtor®

Navigating shifting market dynamics requires expertise. Local Realtors® are your trusted resource—providing insights into neighborhoods, amenities, and financing opportunities that can make all the difference. To learn more about how Realtors® serve buyers and sellers, visit OnlyARealtor.com.